Finance Faculty Updates: Research Includes Affordable Housing, Artificial Intelligence, Wind Energy and More

Members of the FMA at the New York Stock Exchange with their faculty host, Brian Ayash, far left.

Faculty in the Finance Area are always engaged in interesting work that is relevant to our student’s learning, whether it be research, industry work, field trips or classroom activities. You can learn about all of our faculty by checking out their bios on our website. Meanwhile, here are some recent updates:

Bing Anderson

Bing Anderson

Bing’s current research focus is international finance, fixed income, and market microstructure, with particular interest in lead-lag analysis at the tick-by-tick level. He has published papers in the Proceedings of the National Academy of Sciences of the United States of America, Finance Letters, Applied Economics Letters, the International Journal of Theoretical and Applied Finance, Journal of Banking and Finance, Journal of Financial and Quantitative Analysis, and Review of Quantitative Finance and Accounting.

BRIAN AYASH

Brian Ayash, pictured during a college faculty and staff event, recently acompanied students to New York. (Photo/Pat Pemberton)

Ayash recently took students in the Financial Management Association (FMA) on an Investment Banking New York City Corporate Tour, which included visits with several well-known companies.

Vivian Mandell, one of the students on the tour, shared her experience:

Industry professionals generously shared personal experiences, industry predictions, and invaluable career advice, enriching FMA members’ understanding. The tour’s itinerary included visits to TD Cowen, Macquarie, Union Square Advisors, JP Morgan, Jefferies, NAE, and Goldman Sachs, offering a diverse perspective on the cultures and sectors within top investment banks. This firsthand experience expanded FMA’s horizons, allowing members to dream bigger about career pursuits and providing a tangible understanding of corporate life beyond mere online research. Moreover, the tour facilitated meaningful connections with like-minded peers passionate about finance. Building a network of driven individuals is paramount, and this corporate tour provided a unique opportunity to connect on a deeper level, fostering lasting relationships.

During the tour, FMA members had the privilege of visiting iconic landmarks, including the New York Stock Exchange, where they witnessed firsthand the bustling energy of the trading floor, further solidifying their understanding of financial markets. Additionally, the tour included a poignant visit to the 9/11 Memorial, offering a moment of reflection and remembrance, and emphasizing the resilience of the city and its people. Furthermore, FMA had the invaluable opportunity to meet and connect with OCOB alums, forging meaningful relationships and gaining insights into their professional journeys, which served as inspiration for FMA members’ own career aspirations.

FMA is appreciative of the professors, club leaders, and all other parties that made this tour possible. The trip not only elevated FMA’s professionalism and encouraged peer connectivity but, above all, fueled FMA’s motivation to aspire for greater heights and diligently pursue goals.

Ziemowit Bednarek

Ziemowit Bednarek’s article on cannabis garnered headlines nationwide. (Photo/Pat Pemberton)

Bednarek’s most recent article garnered national attention and was viewed over 43,000 times in the first month after publication. The article, published in the multidisciplinary journal PLoS One, was titled “U.S. Cannabis Laws Projected to Cost Generic and Brand Pharmaceutical Firms Billions”

The many news outlets that published the news included the Miami Herald, Wichita Eagle, Charlotte Observer and Fresno Bee.

JOHN DOBSON

John Dobson

The college’s longest-serving employee (He joined Cal Poly in Fall of 1990), Dobson continues to teach classes primarily in Global Finance and Financial Ethics and has recently expanded his research focus to include not just ethics theory, but also aesthetics theory.

Specifically, he is investigating the extent to which the traditional theories of the firm in financial economics can be integrated with recent postructural invocations of business activity as essentially an aesthetic pursuit. This research builds on a growing body of literature that endeavors to overcome the barriers that have traditionally separated economic notions of human activity from moral and aesthetic ones.

SHARON DOBSON

Sharon Dobson greets students during commencement. (Photo/Pat Pemberton)

Dobson was recently featured in the Orfalea College of Business News for her extra credit assignments that incorporate dance. Check out the story.

A finance lecturer for over 25 years, Dobson also currently enjoys her role as faculty advisor to Cal Poly Andaaz Dance Club, Delta Sigma Pi Professional Business Fraternity, Financial Management Association, and MERGE Contemporary Dance Club. Sharon served as Executive Director of Opera San Luis Obispo from 2000-2024, where she was responsible for the planning, managing, and oversight of a nationally recognized regional opera company. She created, implemented, and monitored yearly budgets to ensure adequate cash flows as well as managed the yearly integrated marketing plans.

Currently, Sharon serves on the Cal Poly Arts Advisory Board and Orchestra Novo Board of Directors and encourages her students to understand the important connections between Art and Business.

Garland Durham

Garland Durham

Durham’s most recent work involves the development of methods and software for efficient sequential simulation of Bayesian posteriors.

“Similar methods also turn out to be useful in optimization, which is a key element of classical model estimation, and Durham is actively pursuing research in this area as well,” he said.

Durham is interested in computational issues, especially the development of tools making effective use of massively parallel hardware (e.g., graphics cards) that has become increasing available and powerful in recent years.

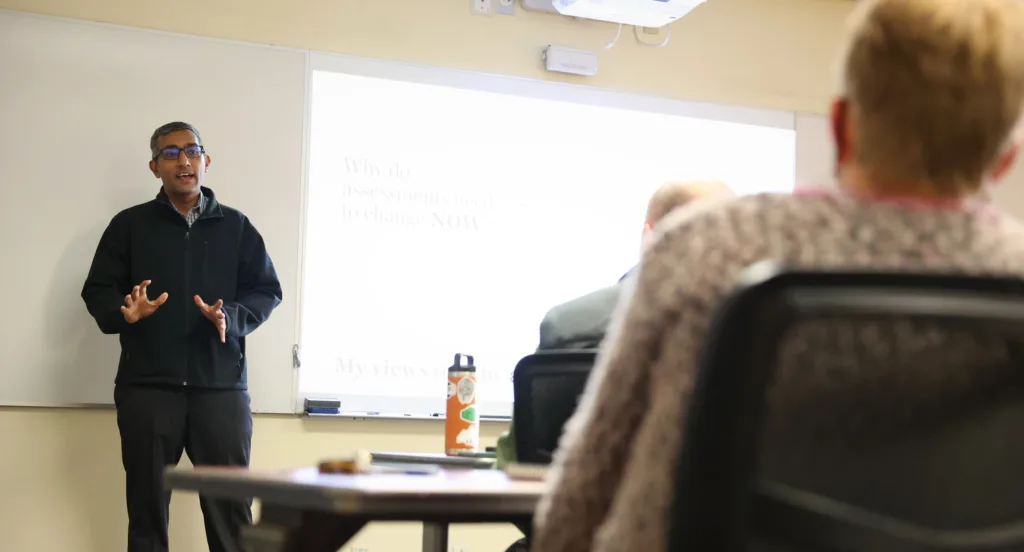

HAMED GHODDUSI

Hamed Ghoddusi speaks to faculty and staff about artificial intelligence in the classroom. (Photo/Pat Pemberrton)

Ghoddusi’s recent research has focused on two major streams: 1) optimal regulation and adoption of artificial intelligence (AI), machine learning (ML), and robotics; 2) Urban/Regional Economics and Housing Policy.

Ghoddusi has been serving as principal investigator (PI) and co-PI on multiple recent Cal Poly grants on subjects such as the Impact of PropTech on Real Estate Industry, Forecasting Regional Economy, and Evaluating Local Economic Development Projects. He is also the faculty advisor of Real Estate and Quantitative Finance (QF) clubs.

Pratish Patel

Pretesh Patel has been on sabbatical. (Photo/Pat Pemberton)

Patel began a year-long sabbatical in 2023. He reports, “As part of my sabbatical, I am studying the economics of affordable housing. From state and federal sources, affordable housing developers often get grants. Together with the Terner Center, we are culling a database of everything from architect expenses to painting costs from scraping information from grants. Housing development is a quagmire, and this database sheds light on its complexities. My ambition is to write a book loosely titled ‘Exorbitant Foundations: The Expensive Reality of Affordable Housing Construction.’”

Cyrus Ramezani and Mahdi Rastad

Mahdi Rastad’s class, with alumni visitors. Rastad is on the front row, center, wearing the green shirt. (Photo/Jahan Ramezani)

The two researchers recently co-authored a study about the potential impact of a proposed wind energy project in Morro Bay. According to the study, which you can read about here, the project would create 24,000 jobs during construction and 600 permanent jobs.

“The three projects in Morro Bay are really the linchpin to the transition to California’s transition to green energy,” Ramezani said.

The 86-page report also detailed how the project would blaze a trail with floating turbines.

Meanwhile, Ramezani, a past area chair, resumed chair duties again roughly a year ago. And Rastad has created a Merger and Acquisition course, a highly in-demand class that is new to our curriculum.

The M&A course offers a comprehensive exploration of corporate transactions, equipping students with vital knowledge and skills for success in today’s business landscape. Through ten topics covering foundational concepts to advanced strategies, students delve into areas such as Valuation, Synergies Analysis, Hostile Takeovers, Deal Design, Due Diligence, Deal Structuring, Leveraged Buyouts, Deal Strategy, Documentation, Fiduciary Duties, and Corporate Restructurings. These topics blend theoretical understanding with practical application, supported by authoritative readings and real-world case studies. Culminating in a Final Project Presentation, students showcase their mastery of M&A principles, solidifying their expertise in this critical field.

The Final Project serves as a practical application of the concepts learned throughout the course, providing students with a hands-on opportunity to develop a detailed merger and acquisition report. After being assigned to groups, students select an industry and identify M&A deals announced in the past two years, focusing on publicly traded firms to ensure data availability. Each group then chooses a deal involving both a target and an acquirer and locates at least one alternative potential target and acquirer. The project requires students to conduct a comprehensive analysis, including M&A market trends, motivations behind the deal, target valuation using various methods, and assessment of synergies. Subsequent reports delve into synergies valuation, deal design, accounting considerations, deal approval processes, alternative deal structures, and a critique of the deal with recommendations for both the buyer and seller. Through this structured approach, students gain practical experience in M&A analysis and develop critical thinking and decision-making skills essential for success in the field.

In addition, the M&A course offers a unique opportunity for students to engage with industry experts through our exclusive Speaker Series. This series brings together professionals from various facets of the M&A landscape, including buy-side and sell-side bankers, corporate development officers, and representatives from the private equity industry, among others. These distinguished speakers, the majority of whom are Cal Poly alumni, offer invaluable insights and perspectives gleaned from their extensive experience in orchestrating successful deals. By providing firsthand accounts of real-world transactions and sharing best practices, the Speaker Series enriches students’ understanding of M&A dynamics and exposes them to diverse viewpoints crucial for navigating complex deal negotiations. Through interactive discussions and Q&A sessions, students gain unparalleled access to industry insights and networking opportunities,

The discretionary Dean’s Excellence Fund supports faculty innovation, which, in turn, allows faculty to provide students the skills needed to be competitive in the workforce. To support faculty endowments, please reach out to Kelly Dye, executive director of development and external relations at kedye@calpoly.edu or 805-756-0740.